Production and playout video server specialist EVS reported 1H 2019 financial results.

Production and playout video server specialist EVS reported 1H 2019 financial results.

A review of the financial results is covered at the bottom of this post. We would like to instead begin the post by casting the topics covered in the earnings release within the historical context of how the drivers of media technology spending have evolved over the past decade.

EVS’s interim CEO (for the past 13 months) Dr. Pierre De Muelenaere began the 1H 2019 earning’s call with an explanation of the business targeted to the investor community. The explanation of EVS’s operations aimed to separate the business between a ‘Maintain’ category of products / customers and a ‘Grow’ category of products / customers.

“We have a ‘Maintain’ business which is our legacy business which is mainly based on the XT ecosystem that we are selling on one side to the OB vans and on the other side to the broadcast center. And this is more kind of a business that we have built over the years with some kind of saturation, and then we have a growth business, which is composed of new products and solutions and also initiatives to go towards a new market” began De Muelenaeree.

The below image was included in EVS’s presentation of the results.

Source: EVS Q2 2019 Earnings Presentation

I have asked for clarification from the EVS team about whether the above is simply illustrative or is instead representative of the relative revenue contribution of the categories or anticipated growth rates. My suspicion is the diagram is illustrative, as there isn’t (at least I couldn’t find) any firmer discussion of revenue contribution or anticipated revenue growth rates. I will update the post once I hear back.

Before it was ‘Maintain’, the XT ecosystem sold into OB trucks and broadcast studios was an exceptional high-margin, growth business. Eight years earlier in August 2011, EVS announced its 1H 2011 financial results. The highlights were €46.1 million in revenue for the first six months of 2011 at a gross margin of 77%. 1H 2019 EVS results were €44.1 million in revenue (slightly lower) at a gross margin of just under 67% (or ten percentage points lower). In 2011 EVS management was already hiring and investing to support the anticipated confluence of 2012 events including the London Olympics. Over the twelve months ending August 2011, EVS added 43 full-time equivalents to its business.

During the first half of 2019 EVS has been implementing its ‘Fight-Back Plan’ to minimize operating expenses without jeopardizing the future of the company (phrase used in 2018 annual report). Those cost measures have meant headcount reduction. In the past twelve months headcount has reduced by 40 full-time equivalents. Overall headcount at EVS has now returned to levels last seen in mid-2012. Even still, spending for R&D in H1 2019 was approximately 16% higher than in the first half of 2011. More provocative, during the same time frame, Sales and Administrative expenses are up more than 50%. In other words, though this is a technology industry, the selling of the technology is taking a much larger piece of the investment needed to drive growth.

EVS management has communicated this need for additional sales and marketing investment to penetrate new markets. Referring to the new markets, De Muelenaere offered the following, “We also can see that this is not just a product game it’s also a marketing game where you need to go to some new markets and we list some of these new markets like esports or corporations or the business that you can do directly with the leader in the federation (sports leagues) and also the extension towards smaller production and extension towards IT.”

The current discussion of new markets wants for specifics. What is certain – as pointed out by De Muelenaere – new markets equals new marketing, which in turn equals new operating expenses. To be fair, EVS management has hinted at a firmer discussion of ‘Grow’ markets at year-end once the team has more operational experience with the new products and customers.

Times have changed. EVS is taking the necessary steps to reorganize its business around a new market reality. This has been happening throughout the supplier community for much of the past years. How the market changed deserves some discussion. Again, we will use EVS to illustrate the point.

EVS experienced 29% year-over-year annual growth at 44% operating margins during the 2012 calendar year based on large events and industry-wide transitions to HD equipment and File-Based workflows. The Company’s 2012 annual report cited both transitions (HD and file-based) as structural growth drivers in the market. “TV stations are investing to move to new and more efficient production workflows, benefiting from the flexibility of tapeless server technologies. EVS is also benefiting from other growth drivers such as the transition from standard definition (SD) to high definition (HD)” read the 2012 EVS annual report.

EVS’s aforementioned earnings announcement in August 2011, cited market sizing for the file-based transition, current market share splits, and anticipated growth rates. And it was targeted at technology refreshes of existing core customers. Let’s just say this level of detail about future growth contrasts with typical vendor communications in 2019. We will save our views on the current state of investor communication by suppliers for the upcoming Devoncroft Executive Summit | Amsterdam.

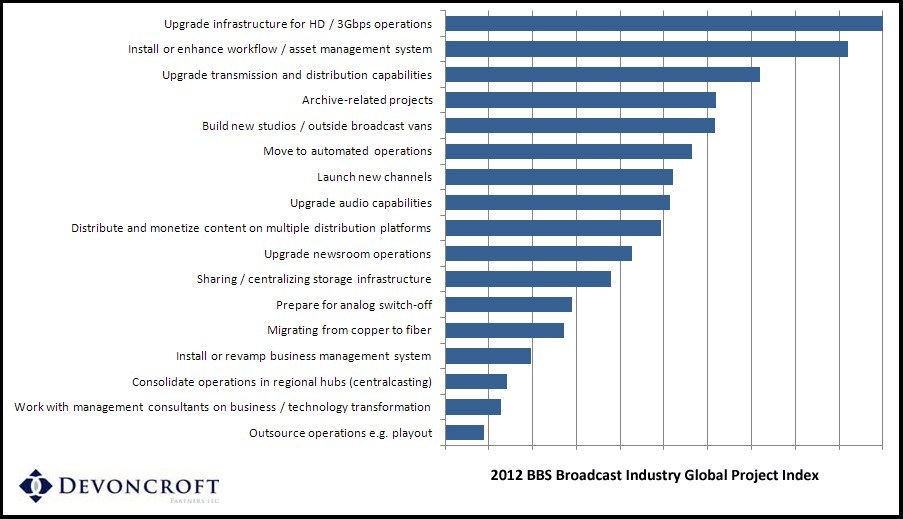

To further illustrate how well EVS was positioned in the second half of 2011, please see the below 2012 Big Broadcast Survey Global Project Index depicting the global budgets of media technology purchasers. The number one budget project globally was ‘upgrading to HD operations’ and the second was ‘Install or enhance workflow / asset management system’ (directly relating to the file-based transition). Incidentally each project held the same position during 2011.

(Please note we have just published the 2019 edition of the above).

The above, of course, has changed. How it has changed – both projects and how budgets are deployed – is largely responsible for the recent supplier restructuring activities. For those interested, this is a central discussion point of the upcoming Devoncroft Executive Summit | Amsterdam.

Highlighting the change in the market environment is the lack of a similar driver (in terms of magnitude) of new purchases outside of the normal equipment upgrade cycle. It hasn’t occurred with UHD, and there is little to suggest that will change.

EVS has been candid and consistent about this point. “We mentioned for quite some time now the OB market is a replacement cycle market. You have seen last year was, and certainly U.S. was really weak because the upgrades were not needed, because the transition to UHD was not needed.” said EVS’s CFO Yvan Absil during its Q2 2019 call.

To be clear equipment refreshes are still happening, just in the course of the normal upgrade cycle, as EVS management has outlined. This is evident in EVS’s results as well. Outside broadcast revenue grew in excess of 40% in 1H 2019 versus 1H 2018. EVS has also disclosed several large future orders such as last week’s press release describing an $8 million upgrade order from NEP.

Our choice of 2011 above as the comparison period is deliberate. Any equipment deployed during 2011 or 2012 is about to conclude its seventh or eighth year of operational life. It is therefore fully depreciated (or nearly) and approaching a reasonable end-of-life scenario. The question is then whether the upcoming refreshes will continue to occur on a traditional (read: long) capital expenditure, hardware basis or whether in 2019 (or perhaps 2020 or 2021) new approaches such Remote Production (REMI) or an embrace of virtualized environments will result in a fundamentally different approach to purchasing next-generation technologies.

We discussed this point at greater length in a post last week. As it pertains to vendor communications, current market drivers are fundamentally different than earlier this decade and are much, much more difficult to communicate to investors. EVS is a timely case study because of the tremendous success the Company enjoyed with the industry’s historical equipment purchase model and its need to now publicly communicate the transition to a new model.

Financial Metrics from 1H 2019

Revenues for the first half of 2019 were €41.0 million, a decrease of 6.9% over 1H 2018 results. Excluding the effect of big event rentals, EVS’s 1H 2019 revenue increased 12% versus the year earlier period.

As we have observed during past posts covering EVS results, odd-year revenue declines are not unusual given the cyclical nature of EVS’s business around major live events.

Driving the non-event revenue during the 1H 2019 was growth in the Americas, which increased 46% on a year-over-year basis.

Gross margins for the first half were 69.7%, a 280 basis points increase above the 66.9% level in 1H 2018. Gross margins improvement was attributed to an improved product mix.

Operating profit for the first six months of 2019 was €3.4 million, a 48% increase compared to 1H 2018. Operating margin for the first half was 8.3%, up from 5.3% during the same period in 2018. Margin improvement was driven by operating expense reduction of 7.1% versus the 1H 2018 (in turn driven by ‘Fight-Back Plan’).

Net profit for 1H 2019 amounted to €3.7 million (€0.26 per share), a substantial decline from the €10.6 recorded during 1H 2018, though the comparison period included a one-off ‘innovation box’ credit of €6.6 million from the Belgium government. Exclude this grant, year-over-year net profit increased 7.1%.

Business Outlook:

The order book stood at €22.5 million as of June 30, 2019. This represents a 19% increase over the order book last year at the end of June.

As part of the earnings release, management reiterated the previous revenue guidance for full year 2019 of €100 million to €120 million.

Capturing Management’s optimism for the full year 2019, Pierre De Muelenaere, Chairman of the Board and Interim CEO said, “Thanks to a good funnel, we expect a continued momentum and stronger second half in a remaining challenging market condition. I am also pleased to continue our collaboration with NEP, which has once again placed its trust in EVS to renew its US production activities. This is one of the elements that allow us to remain confident in the achievement of our earlier announced revenue guidance.”

Related Content:

© Devoncroft Partners 2009-2019. All Rights Reserved.